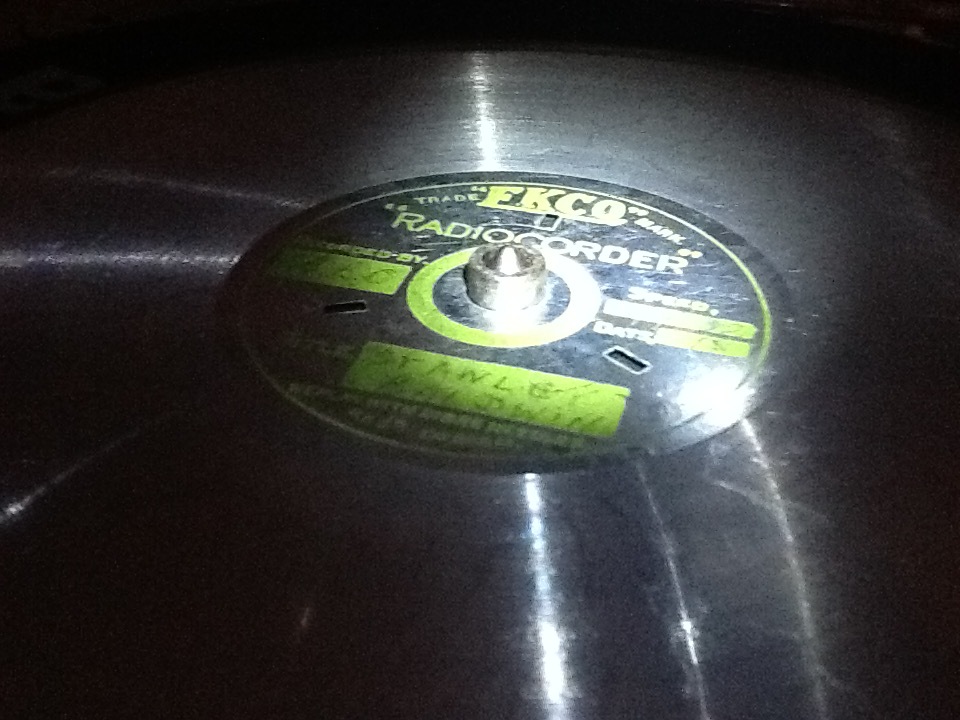

This EKCO disc is a unique recording of my grandfather introducing a radio broadcast made by Prime Minister Stanley Baldwin on 1st July 1932. In his broadcast Mr Baldwin refers to chancellor Neville Chamberlain and 3.5 million “War Loan” letters. Emphasis is placed on the logistic feat and the tone is upbeat. But in truth these letters dealt a financial blow to many. For this was an occasion where Britain effectively defaulted on its debts. Furthermore the creditors left indebted were not a foreign power but the British people themselves.It is 1932 and the global economy is mired in The Great Depression. Confidence in the markets has fallen, along with investment and borrowing. The Gold Standard has fixed the allowable level of cash in circulation to the state's reserves of bullion. This has limited the money supply from central banks. The resultant deflation has encouraged investors to hold onto money and refrain from lending. Global trade, consumer spending and business has shrunk. The result has been unemployment with economies needlessly languishing at low GDP for want of cash flow.

Unemployed workers from the industrial regions march on London in protest

During the banking crisis of 2008 the Bank of England was free to inject cash to avoid deflation, stimulate growth and prevent recession becoming depression. But in 1932 Chamberlain's attention was on the deficit between Government spend and revenue from tax. He saw the “War Loan” accounted for much of it. This loan comprised Government bonds which were sold to the public to raise finance for WW1 in 1917. Popular with the patriotic investor they delivered a 5% annual return over a 30 year term ending in 1947 when the loan would be repaid. These bonds were legally binding but Chamberlain saw he had an opportunity to loosen them.Firstly the Government held the right to repay the loan early or re-issue the bonds at a lower return subject to consent. Secondly, returns everywhere were poor so bond-holders had few options making them more pliable. Thirdly, the bond-holders were British people. Patriotic duty was why many people had bought them in the first place. Finally the pound started falling against the dollar. This would disincline bond holders from foreign investment.

Bond certificates were issued with coupons which would be cut out and exchanged for cash at the Post Office

So Chamberlain went to the banks and financial firms. He persuaded them to accept re-issued bonds on behalf of their bond-holding customers. These would have a reduced return of 3.5% and there would be no redemption date on which the loan had to be repaid. His private meetings were accompanied by a public media campaign emphasising patriotic duty. Bonuses were also offered to those who consented early.In truth the “perpetual” bond would take almost 30 years just to deliver the loan back with huge losses in its worth against inflation. My grandfather realised this as did the Chairman of the Midland Bank. He is reported to have lost a peerage on account of his refusal to comply. Instead he forced the Bank of England to step in and purchase his customer's bonds. But generally Chamberlain's campaign was a success. Many holder's were swept up in a tide of patriotism and peer pressure.

The question of whether Chamberlain did the “right thing” is unanswerable. Wealth was transferred from many private coffers to the Government’s. Was the money then spent in a better way? With WW2 looming and the need for national rearmament perhaps it was. But with less money in the pockets of many people perhaps the economy took longer to recover. Perhaps if he'd maintained the "War Loan" the Chancellor would have been able to reduce the deficit by encouraging the economy, reducing unemployment and increasing GDP and tax revenue. In any case it is ironic that a Conservative chancellor should nationalise a large amount of private wealth in the manner expected of a Communist state.And what eventually became of the "perpetual" bonds? Well in 2015 another Conservative chancellor George Osborne finally redeemed them. By then the bonds had been traded for decades in the city and were owned by a few banks and firms. The final settlement is reported to have amounted to £1.9billion. And how did the chancellor raise that capital? With interest rates staying low he was able to sell a new set of bonds giving even lower returns. So 83 years after Chamberlain he was able to pull off a similar trick to reduce Government spend.

“This is a moment for Britain to be proud of. We can, at last, pay off the debts Britain incurred to fight the first world war. It is a sign of our fiscal credibility and it’s a good deal for this generation of taxpayers. It’s also another fitting way to remember that extraordinary sacrifice of the past.”George Osborne echoes Neville ChamberlainGreenbank Records, Plymouth, England